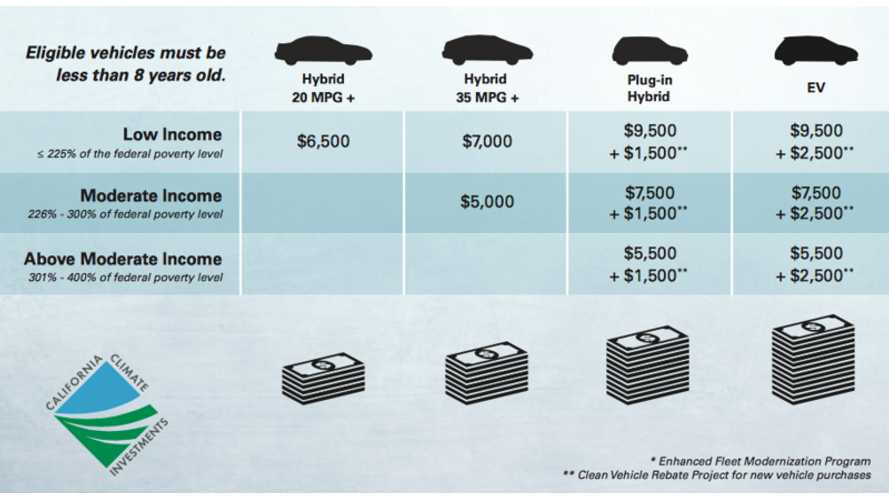

California Electric Vehicle Rebate Taxable Income - Ca Electric Car Rebate, The state has spent more than. Consumers are not eligible for cvrp rebates if their gross annual incomes are above the thresholds listed below. The California Electric Car Rebate A State Incentive Program OsVehicle, California drivers may also be eligible for the electric vehicle (ev) rebate program. The income cap applies to all eligible vehicle types except fuel.

Ca Electric Car Rebate, The state has spent more than. Consumers are not eligible for cvrp rebates if their gross annual incomes are above the thresholds listed below.

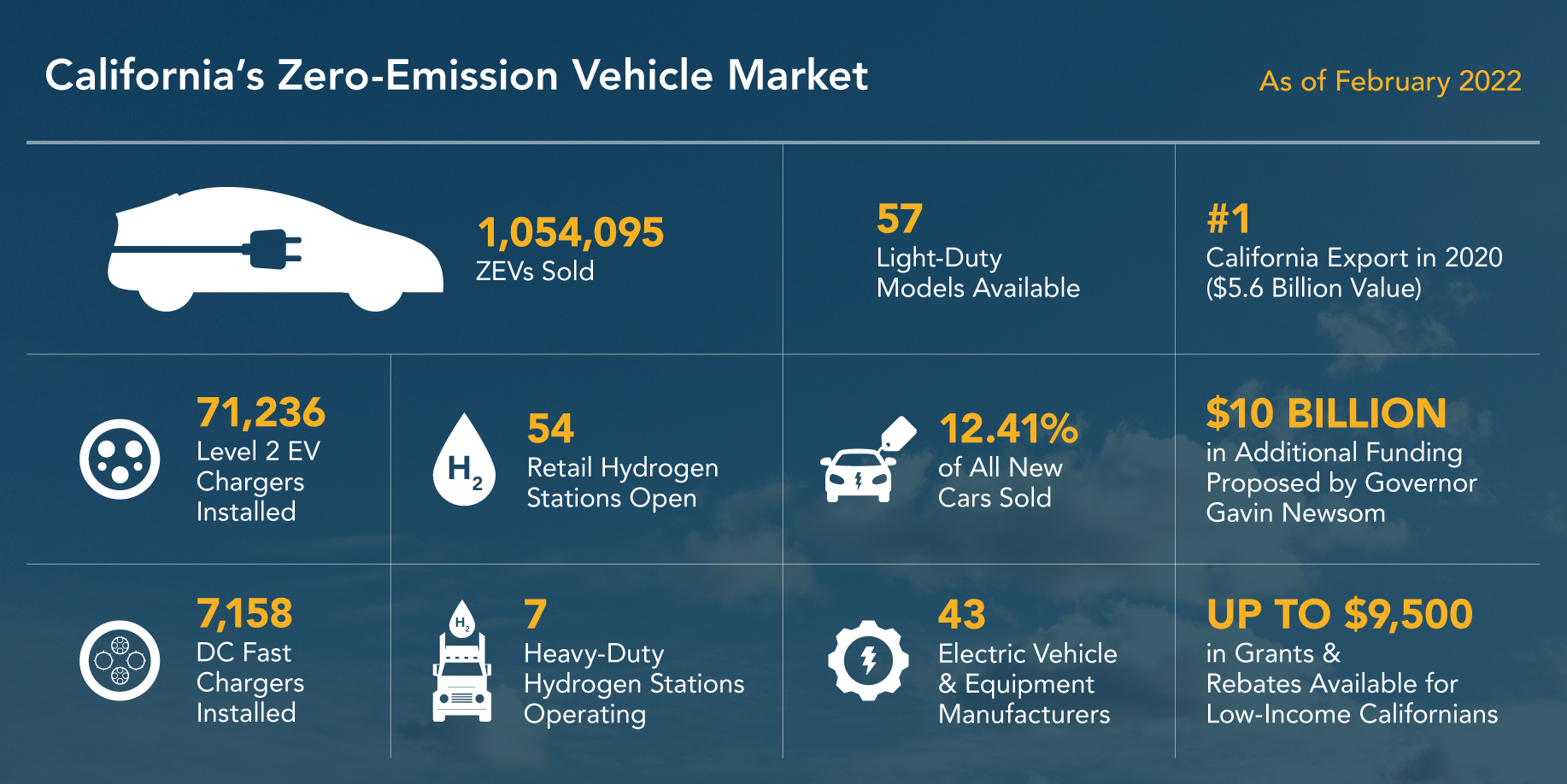

California Leads the Nation’s ZEV Market, Surpassing 1 Million Electric, California is eliminating its popular electric car rebate program — which often runs out of money and has long waiting lists — to focus on providing subsidies only to. That allocation was exhausted on feb.

Electric Vehicle Tax Incentives & Rebates Guide Constellation, The state has spent more than. Does california have tax credits for buying new evs?

Going Green States with the Best Electric Vehicle Tax Incentives The, Rebates for drivers who qualify boosted to $7,500 for electric vehicles and $6,500 for. Your new electric vehicle could qualify for up to $7,500.

Electric Vehicle Tax Credits and Rebates Explained 2025 TrueCar Blog, Your new electric vehicle could qualify for up to $7,500. Rebates for drivers who qualify boosted to $7,500 for electric vehicles and $6,500 for.

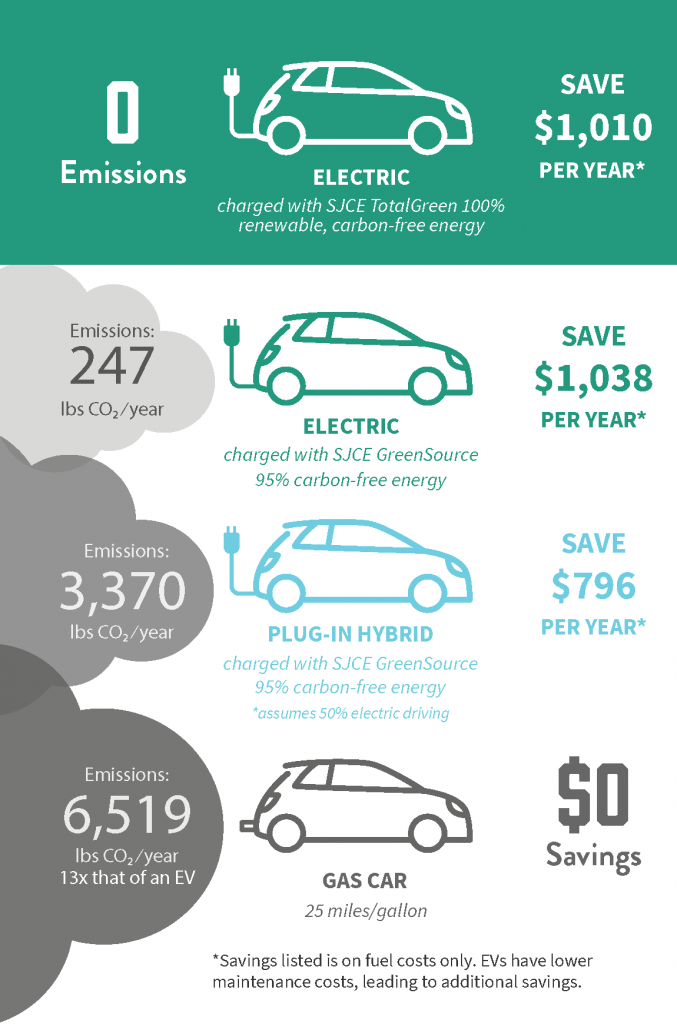

Electric Vehicles San Jose Clean Energy, Consumers are not eligible for cvrp rebates if their gross annual incomes are above the thresholds listed below. Yes, the california air resource board’s (carb) clean vehicle rebate project offers $1,000 to $7,500.

Yes, the california air resource board’s (carb) clean vehicle rebate project offers $1,000 to $7,500.

California Electric Vehicle Rebate Taxable Income. Is the california electric car rebate taxable? According to the clean vehicle rebate project that administers the california rebate,.

California boosts electric car rebates for families, Your new electric vehicle could qualify for up to $7,500. The state has spent more than.

Does california have tax credits for buying new evs?

Ca Electric Car Rebate Limit, Yes, the california air resource board’s (carb) clean vehicle rebate project offers $1,000 to $7,500. Rebates for drivers who qualify boosted to $7,500 for electric vehicles and $6,500 for.